Cura Update - Spring 2025

September 2025

Cura Team News

Spring is here and with it comes that classic Kiwi dilemma, do we grab a jacket, or risk it in a T-shirt? One minute the heat pump is working overtime and next the windows are flung open to let in the breeze. This year has been just as changeable (but in a good way!) for us at Cura. We’ve reintroduced KiwiSaver to our service offering, launched our very own Cura app (more on this below), and even managed to get the office roof fixed (fingers crossed we’re finally leak-free). In between, we’ve been busy reviewing insurance and KiwiSaver with existing clients, welcoming new clients and supporting several clients with claims. On top of that, we recently sailed through our annual compliance audit with flying colours, a great reminder that all the behind-the-scenes checks keep us on track and focused where it matters most - looking after you.

Cura App

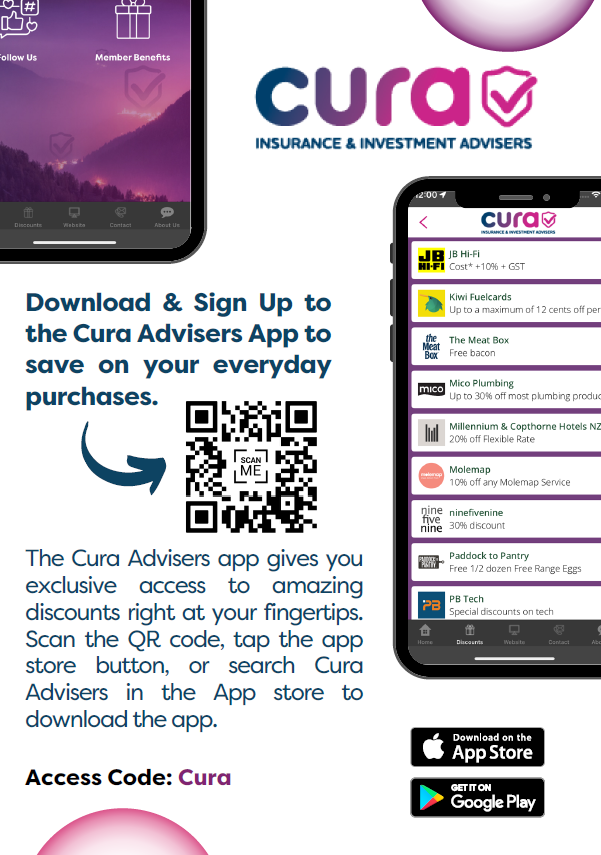

We’ve launched the Cura app to make it even easier to stay connected with us. On the app you’ll find everything you need to know about who we are, how to get in touch, where to follow us on social media, plus access to some great member benefits, including discounts through various companies such as JB Hi-Fi, Mico Plumbing, Carters, Pita Pit, Placemakers and Warehouse Stationery to name a few. It’s simple, handy and all in one place (and don’t worry, no personal policy details are stored on the app).

Check out our Cura App - QR code below

Financial & Insurance News

The good, the bad and the ugly... here's the latest trends we're noticing and some helpful info to keep you in the loop.

The Rising Cost of Medical Insurance

Let’s start with the elephant in the room - the rising cost of medical insurance.

The public healthcare system continues to struggle. Changing governments with different views on how healthcare should be run have created a bit of a political ping-pong match, and there’s still no clear, long-term direction. Waitlists are growing, the system is stretched thin and more Kiwis are turning to private healthcare to get the care they need - faster.

In the past couple of years alone, over 250,000 more New Zealanders have taken out medical insurance. That brings the total number of Kiwis with cover to around 1.5 million that’s roughly a third of the country now relying on private health insurance.

So if more people are paying premiums, why are those premiums increasing?

Here’s why:

- Medical inflation has soared in 2025, medical inflation hit 14.5%, one of the highest rates globally. This means procedures, treatment and healthcare services are all costing significantly more than they did just a year ago.

- Claim volumes are surging insurers are paying out more than ever.

- Partners Life paid out $325 million in claims in the last financial year (up $50 million from the previous year).

- nib saw a 320% increase in chemotherapy claims over a 9-month period.

- AIA reported a $95 million year-on-year increase in claims across life, trauma and health.

Insurance companies base premiums on the expected number and cost of claims. When the reality overshoots expectations, they have no choice but to raise premiums, to ensure they stay financially strong (in simple terms, so they don’t go bust).

We know some of the recent increases are significant and we understand that this adds extra pressure on household budgets. One practical way to help manage the cost is to review your excess.

Increasing your excess means you'd pay more up front if you claim, but in return, your regular premiums are lower - because you’re taking on more of the risk yourself.

Medical insurance is becoming more of a necessity than a luxury, but it still needs to be affordable. If you have concerns or want to explore options to reduce your premiums, please get in touch for a chat.

KiwiSaver Big Changes Ahead

Let’s start with the good news:

16- and 17-year-olds now qualify for the government contribution (previously this started at 18).

Minimum contribution rates are going up - for both employees and employers. These increases will be phased in over the coming years. We think this is a great move.

Why?

If we compare to Australia, their average superannuation balance at retirement is around $400,000. In NZ, the average KiwiSaver balance is around $69,000. With the NZ Superannuation sitting at around $27,000/year for a single person, many Kiwis are falling short of what’s needed for a comfortable retirement.

Now the not-so-good news:

The government contribution is being halved.

Until now, the government chipped in 50 cents for every $1 you contributed, up to a max of $521 a year. This is dropping to 25 cents per $1 contributed, capped at $260 per year.

Still, something is better than nothing - and with higher contribution rates, the long-term impact on KiwiSaver balances should still be positive.

There’s been a fair bit of market volatility recently due to global events. But it’s important to remember markets go up and down, but the long-term trend is upwards. For everyday investors, it’s about time in the market, not trying to time the market.

A Quick KiwiSaver Check-Up

It’s a smart idea to get advice to make sure the basics are in order - like your fund type, provider, tax rate and contribution level. Spending a bit of time now to get it right can make a huge difference to your future nest egg.

Curas Spring Wellness Tip

- Declutter for Clarity - Spring cleaning isn’t just for the house, it’s a great time to clear out mental clutter too. Write down three small things that have been on your mind and tackle one each week. You’ll feel lighter and more in control.

- Hydration Habit - As the weather warms up, it’s easy to forget to drink enough water. Keep a reusable bottle handy and aim for a few extra glasses a day. Staying hydrated can boost focus, mood and energy. Small habit, big payoff.

- Start the Day Outside - Even five minutes of fresh air in the morning can set a positive tone for the day. Grab your coffee or tea and enjoy it outdoors. It’s a simple way to wake up your body and get that spring sunshine working for you.

- Plant Something - Whether it’s a pot of herbs on the windowsill or flowers in the garden, growing something green can be surprisingly good for wellbeing. It gives you a small daily win, plus fresh herbs make dinner taste even better!

- Financial Wellness Refresh - Spring is also a good time to “tidy up” your finances, review your budget, check in on your KiwiSaver or insurance cover and make sure everything still fits where you’re at. A little review now can bring peace of mind for the months ahead.

Cura is always here for you - contact us today

There’s always a lot going on in the world and managing money is one of those things that can feel overwhelming. Having someone to guide you through when needed can be incredibly valuable and give you peace of mind that you’re on the right track.

Whether you need help with something we specialise in, or something outside our scope, we can either help directly or connect you with someone who can.

We look forward to catching up soon, and in the meantime, if you have any questions at all, or would like to chat, please get in touch via admin@curaadvisers.co.nz, or by phoning us on 06 349 0089.

--

Disclaimer: Please note that the content provided in this article is intended as an overview and as general information only. While care is taken to ensure accuracy and reliability, the information provided is subject to continuous change and may not reflect current development or address your situation. Before making any decisions based on the information provided in this article, please use your discretion and seek independent guidance.

Cura Advisers Limited holds a Full licence (Class 2) issued by the Financial Markets Authority (FMA) to provide financial advice. You can view our our disclosure information here. If you have any questions regarding this, please let us know.